When Are Taxes Due 2025? Tax season can be stressful, especially if you’re unsure of the exact deadlines or how to file for an extension. Fortunately, the Internal Revenue Service (IRS) has clarified key details for taxpayers in 2025. Whether you’re planning to file early or need more time, here’s a concise guide to the 2025 tax deadline, how to request an extension, and what it all means for you.

When Is the 2025 Tax Deadline?

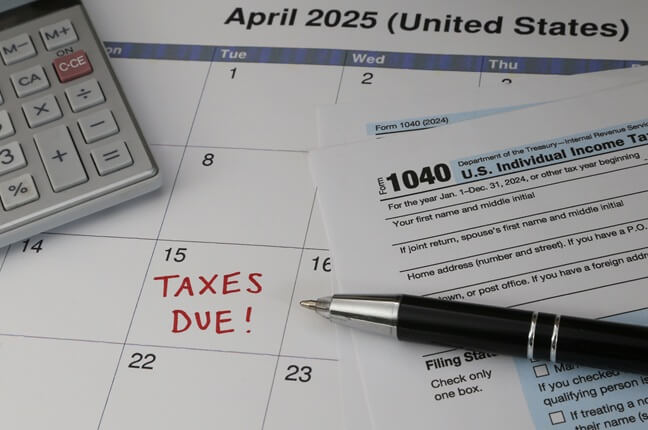

For many Americans, tax day in 2025 is Tuesday, April 15. This is the last day to submit your 2024 federal income tax return to the IRS. Even though the deadline doesn’t change from year to year, it’s always smart to double-check your calendar if it’s a holiday or a weekend. In 2025, April 15 is a normal business day, so the usual deadline holds.

The IRS anticipates that more than 140 million tax returns will be filed this year. Through April 4, more than 101 million individual returns already had been received, demonstrating that a majority of taxpayers like to file early and skip the last-minute rush.

Who Qualifies for an Extended Deadline?

Most individuals have to file by April 15, but some taxpayers hit by natural disasters qualify for automatic extensions. For instance:

Victims of the California wildfires now have until October 15, 2025.

Those who have been affected by Hurricane Helene and Hurricane Milton in Florida, North Carolina, and South Carolina have until May 1, 2025, to file their returns.

Disaster-hit areas in Alaska, New Mexico, Kentucky, and other areas are also entitled to delayed tax deadlines between May 1 to November 3, 2025.

If you are not sure about your eligibility, visit the IRS’s state-specific disaster relief webpage or call their general helpline at 1-800-829-1040.

Also read: How To File A Tax Extension? Tax Return Deadline by April 15

What Is a Tax Extension?

An income tax extension gives you more time to file your federal income tax return—but not more time to pay what you owe. The IRS makes it clear that an extension postpones the paperwork, not the payment. If you don’t pay on time by April 15, you can still be charged interest and penalties.

A normal extension provides an additional six months, pushing your new due date to October 15, 2025.

How Do You File for a Tax Extension?

There are three primary methods of requesting an extension:

Utilize IRS Free File to file an electronic extension form.

Pay taxes online and specify that the payment is for an extension.

File IRS Form 4868, the official tax-filing extension application. The form can be filed online, through a tax preparer, or by mail.

Form 4868 asks for your name, address, Social Security number, and an estimate of your tax liability. Luckily, there is no cost to file this form.

What is the deadline for Requesting a tax extension?

The deadline to file for an extension is the same as regular tax day—April 15, 2025. If you’re late and haven’t filed your tax return, you’ll be subject to penalties unless you’re eligible for a disaster-related extension.

Is Filing a Tax Extension a Good Idea?

As tax professionals see it, obtaining an extension makes sense. Financial planner Tyler Horn of Origin says extensions prevent costly errors. “If you hurry, you can make mistakes,” he says. “It’s best to take your time and get things right.”

Most taxpayers procrastinate due to financial hardship or because they have not yet received all of their tax papers. A new Harris Poll indicates that 41% of Americans have put off filing this year—particularly young adults such as Gen Z and millennials.

Requesting a tax extension provides you with leeway to get your papers together, particularly if you are self-employed or juggling several sources of income.

But remember this: you still have to pay your taxes by April 15, even if you get more time to file.

Final Thoughts

Knowing the 2025 tax deadline and how to file a tax extension can make this year much less stressful. If you need additional time, the IRS has made it easy. Just remember to file your taxes—or your extension—by April 15, 2025, to prevent penalties. If you’re a victim of a natural disaster, you might already qualify for an extension automatically.

Stay up to date, plan, and think about hiring a reputable tax professional to ensure it’s correct. Don’t rush through it—use an extension if necessary and file with confidence.

FAQs

Q1: When is the tax deadline 2025?

The tax deadline 2025 is Tuesday, April 15. This is the last day to file your 2024 federal income tax return with the IRS unless you apply for an extension.

Q2: What is the last day to file taxes 2025?

The last day to file taxes 2025 without an extension is April 15, 2025. Filing late without an approved extension can result in penalties and interest.

Q3: How to file a tax extension 2025?

To file a tax extension 2025, you can use IRS Free File, pay your taxes online and select “extension,” or submit IRS Form 4868 electronically or by mail.

Q4: What is the tax extension deadline 2025?

The tax extension deadline 2025 is October 15, 2025. This gives taxpayers six more months to file their return, but not to delay payment.

Q5: Can I still file taxes after the deadline 2025?

Yes, you can file taxes after the deadline 2025, but unless you filed an extension or qualify for disaster relief, you may face late filing penalties.

Q6: Is there a penalty for filing taxes late 2025?

Yes, filing taxes late in 2025 without an approved extension can lead to penalties and interest. However, if you file Form 4868 on time, you can avoid the late filing fee.

Q7: Should I file a tax extension 2025?

You should file a tax extension 2025 if you’re missing documents or need more time to file accurately. It helps avoid errors and last-minute stress.