Nvidia is well ahead in the segment of AI hardware, with its Blackwell AI server racks greatly leading innovation. The production ramping up gives investors something to look forward to with excitement regarding earnings from this company. Fortunately, logistical issues have been overcome, and shipments have begun to flow at a faster rate, fortifying Nvidia’s position in the sector.

Blackwell AI Server Production Gains Momentum

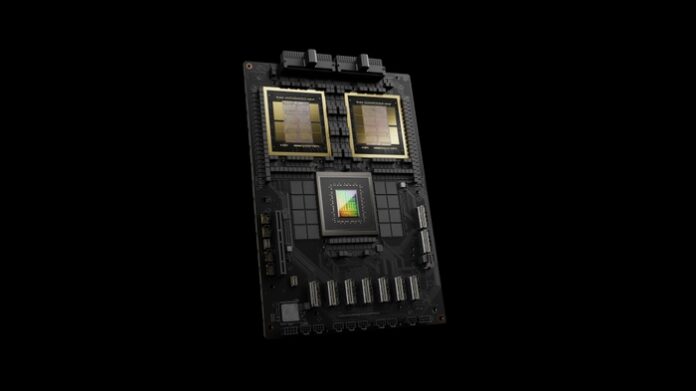

Nvidia’s manufacturing partners, including Foxconn, Inventec, Dell, and Wistron, have overcome production challenges. By this time, these suppliers have solved heating problems, liquid cooling leaks, and software bugs for smoother shipments. The Blackwell GB200 racks integrate 36 Grace CPUs and 72 Blackwell GPUs for high-performance AI processing.

Also read: SpaceX Starship Explodes in Space After Launch – March 2025

Technical Challenges Overcome

There were initial delays for Nvidia owing to the complex engineering problems. Testing was to be completed before synchronizing many AI processors into one server. This has improved efficiency for production, allowing shipments to increase speedily due to developed cooling systems and more optimized interconnects.

Investor Confidence and Market Impact

Following Nvidia’s production breakthroughs, the general outlook for investors buoyed the market. Accordingly, the stock advanced by 2.5% in pre-market on May 27. Blackwell has been emphasized by CEO Jensen Huang to be the fastest rollout in history at Nvidia, an important factor for confidence among investors.

Expected Earnings and Growth in the Future

Nvidia’s earnings report will impact its expansion into AI hardware. Strong revenue growth will be expected and modeled on the increasing numbers of Blackwell shipments, but according to the forecast, with the support of the forthcoming GB300 AI rack outfitted with even better memory capabilities, it is ready to make further market inroads.

AI Industry Implications

The whole AI industry is dependent on Nvidia’s devices to run big language models. With Blackwell providing improved performance, companies such as Microsoft and Google will be able to better scale their AI applications. Besides, the speedy scaling of production by Nvidia ensures that AI developers will shortly get more hardware faster to deploy AI models.

Venturing into New Markets

Nvidia, on the other hand, remains expanding its AI hardware market reach beyond the conventional spaces. The company has secured mega orders from Saudi Arabia and the UAE for the growing rise in demand within emerging economies for AI infrastructure. On the contrary, such diversification only fortifies Nvidia in the global footprint and revenue streams.

Competitive Landscape

Nvidia is a major force in AI hardware, but competition is growing stronger. However, this does not stop rival companies like AMD and Intel from working toward introducing alternative AI chips to remove Nvidia’s dominance. But, taking into account, Nvidia has taken rapid strides in production scaling and its accelerations into technology advancements, it remains to dominate the pack.

Enhancing the Supply Chain Efficiency

Nvidia has managed to sensitize the entire supply chain to meet increased demand. It streamlined its logistics in this view to minimize delays, increase delivery timeliness, and ensure that the AI developers receive hardware sooner, allowing them to get their AI models into production quickly.

Future Innovations and AI Expansion

Beyond Blackwell, Nvidia is investing in future AI chips. The upcoming launch of the GB300 AI rack will be equipped with memory capabilities to support more advanced reasoning models in AI. Thus, this will strengthen Nvidia’s position in AI computing more and more.

Also read: Vandenberg SFB Launch Schedule & Key Missions 2025

Conclusion: Nvidia’s Market Dominance Strengthens

Nvidia’s Blackwell AI server production boost marks the beginning of a new chapter in AI computing. Technical challenges have been strong to build investor confidence and drive stock gains. With the earnings report for Nvidia approaching, the company positions itself as a leader in strategic advancements in AI hardware innovations.