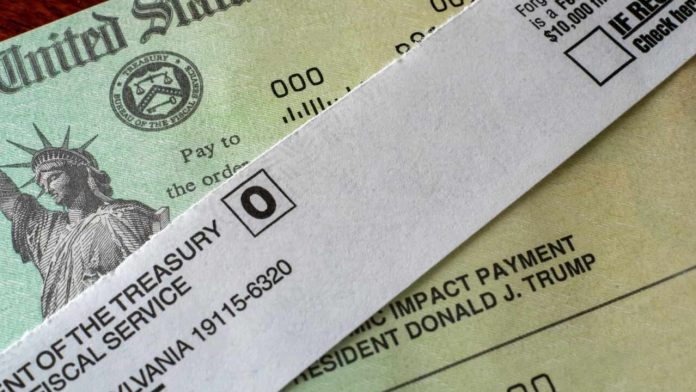

For millions of Americans, IRS direct deposits (stimulus check) help keep them afloat when money gets tight. The IRS put out checks at the start of the COVID-19 crisis to help people pay their necessary costs like rent, food, and utility bills. The IRS sent multiple stimulus payments time after time to specific sets of qualified taxpaying groups.

In 2025 the IRS restarted giving stimulus payments to people who didn’t get help before. The IRS team wants to fix mistakes from earlier programs and give qualified taxpayers their fair amount. The $1,400 stimulus check now join previous payments to help families around the United States fight their financial challenges.

What Are Stimulus Checks?

Through stimulus checks, the United States government disburses funds directly to beneficiaries. The government set up these payments to help people deal with financial problems from the economic crisis that hit hardest during the pandemic. The IRS sends stimulus money to taxpayers who qualify according to its rules.

The federal government uses these payments to put money back into the economy and give eligible people funds for their essential living costs. Middle-income households who meet the payment criteria can benefit alongside families with lower incomes and unemployed individuals.

Also read: IRS Tax Filing 2025: Start Date, Refunds & Filing Tips

Why Are Stimulus Checks Issued?

When public health or economic emergencies strike the government sends out stimulus checks as quick financial help for American citizens. As COVID-19 spread millions of Americans faced unemployment received reduced work schedules and saw healthcare prices escalate. The government distributed these payments as a fast method to help people.

During 2025 IRS set up assistance for people who failed to put their Recovery Rebate Credit on their 2021 tax return. IRS wants to support those who failed to properly file their taxes or did not know the prior steps for the recovery rebate credit.

Who Is Eligible for the $1,400 Stimulus Checks?

You may qualify for the payment if:

- You filed a 2021 tax return.

- If you are single or married you must earn less than $80,000 annually to qualify for the payment.

- You forgot to include your RRC information or put zero in its designated area.

- You must hold either U.S. citizenship or resident alien status and file taxes yourself.

Each person can receive up to $1,400 in payment. The benefits you receive depend on the number of members who qualify to be your dependents. A household with four members can collect $5,600 through the program. Your payment amount depends on your income and your tax reporting method.

How Are Payments Delivered?

The IRS runs this program smoothly without any manual work required. Your payments arrive through financial deposit or regular paper check delivery. Here’s how it works:

1. Direct Deposit:

Your IRS direct deposit information from your tax return will automatically receive the payment deposit into your selected account.

2. Paper Checks:

When no banking information exists the IRS delivers the payment by post to your tax return address.

3. Notification Letters:

When you send your payment the IRS will mail you a notification that explains how much you paid and the delivery choice. Hold this letter safely as a part of your financial records.

Customers who receive their stimulus payments will find them either in their bank accounts or by post office delivery in late January 2025.

How Would Things Work If You Never Filed Your 2021 Tax Returns?

Those who missed filing 2021 taxes can take important steps now to receive their stimulus payment. April 15th, 2025 stands as the final deadline to provide your 2021 tax data. If you file now you will have access to the Recovery Rebate Credit that pays your stimulus funds.

Sending your tax information to us will let you receive the benefits you qualify for even if you don’t need to file or make money. Use the IRS Free File tool to get help with your digital tax filing at the federal level.

Rumors About a Fourth Stimulus Check

Social media users are now discussing news about possible $1,800 stimulus money in 2025. Despite social media speculation about a fourth round of payments there has been no official government confirmation about new stimulus check.

People spread false information online that $1,800 is real compensation. You should depend only on government-approved IRS updates and official sources to learn correct check information.

Why Is the IRS Sending Stimulus Check Again?

Many taxpayers incorrectly handled their 2021 tax filings within the Recovery Rebate Credit area. Most taxpayers wrote nothing or filled in the section wrong because they believed they did not qualify.

They audited tax records to find taxpayers who needed their missing payments. They are now sending automatic payments to guarantee that everyone receives the help they need. This program demonstrates how the government stays committed to helping its people when a crisis hits.

Stay Informed and Avoid Scams

Check the IRS website every day for precise information on how to access your payments. Visit the IRS Get My Payment tool to see your payment developments. Watch for scams because unsafe websites social media wrong information and forged deals can trick you. The IRS does not ask for your personal data through email phone or text messages. Check all IRS communication through direct contact with their office. Call the IRS or local police right away when you notice anything fishy to keep yourself and others from getting cheated. It’s your duty to stay alert to protect what you own.

Conclusion

Millions of Americans rely on IRS stimulus check to help them through tough periods. The $1,400 payments remain available, but you must take necessary actions, file your returns, and stay current on updates to receive them. If you need to adjust errors on your past tax return or submit a fresh document, you can still add the correct information to your tax record to claim these funds.

Take action now to receive your part of the financial aid, ease financial burdens, and help your loved ones cope with money problems during these challenging economic times.