Tracking income tax refunds in the United States is considered one of the most essential parts of the tax filing process. Many taxpayers after submitting their tax returns wish to know when they will receive their tax refunds in their accounts. Therefore, the IRS offers simple tools that make tracking your tax refunds easier. If you are someone who wishes to know how to track your tax refunds, this article is for you. It brings you all you need to know about how to check the refund status including steps to use the “Where’s My Refund” tool and how to receive your tax refunds sooner.

How Do We Track Our Tax Refund Status?

If you wish to track your tax refund status, it is important for you to know that the IRS accepts tax returns within 24 hours of the e-filing. Once the tax regulation agency accepts your return, you will then have the facility to track your refunds. The processing of the refunds as well as its delivery may take at least three weeks after acceptance.

In case you are filing the tax returns online using the tax software, your provider will email you a confirmation of the acceptance. The taxpayers can usually track the tax returns e-filing acceptance status through a direct login into the tax software. You can see the expected refund amount on the software as well. You will have to note the amount down for using the “Where’s My Refund?” tool.

Also read: Where’s My Refund? Track IRS Status & Avoid Delays

How Do We Track Our Tax Refund Using The “Where’s My Refund?” Tool?

The IRS “Where’s My Refund?” tool is famous as one of the fastest ways to track the federal tax refund status. The agency reportedly updates the tracker every 24 hours after you have filed your return online. However, this may take longer if you have mailed a paper return. The agency will update the tracker within four weeks in such a case. The following is a set of a few steps that you must follow to use the tracker for tracking your refund status.

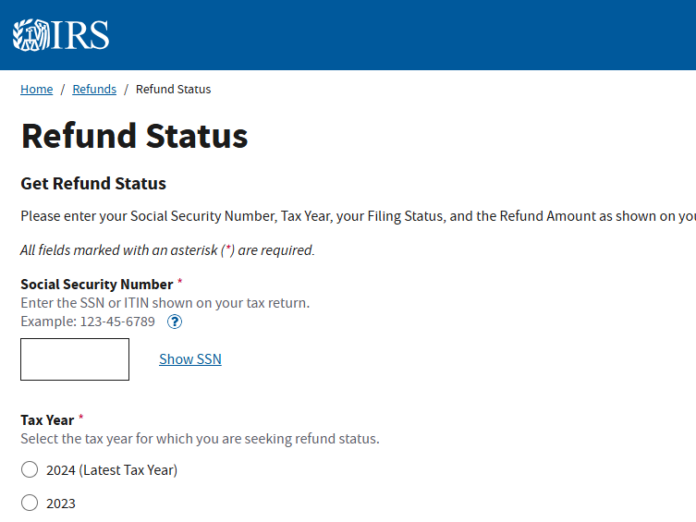

- Step 1: Whenever you wish to track your tax refund status using the tracking tool, you must ensure that you have three things in your hand. These three things include your social security number/individual taxpayer number, your filing status, and the expected refund amount.

- Step 2: Once you have filled in all the required details, the tracker will show you the status of your refund. It will show you whether your refund is in the acceptance, approval, or sent stage. In case there is a delay or an issue with your refund, the tracker might ask you for further information or contact the IRS.

In case you have submitted a 2022 or 2023 tax return, the agency will update the tracker about the status of your refund within 3 to 4 days. If you are someone who wishes to check the amendment refund status, there is a different tracking tool available for it. You can also use the IRS’ mobile app, IRS2go, to track your refund status or call the hotline at 800-829-1954.

IRS Tax Refund Schedule 2025

The Internal Revenue Service (IRS) does not issue any official calendar for tracking tax refunds. However, it does provide basic guidelines for when exactly you can expect to receive your tax refunds. Taxpayers who have filed an error-free 2024 tax return online can expect to receive the tax refunds within a span of 21 days. On the other hand, those who mailed the paper return can expect the returns within a span of four weeks or more.

| Filing Method | Refund Method | When To Expect Refund |

| E-file | Direct deposit | Within 21 days |

| E-file | Check | Within 21 days and an additional one week for check delivery |

| Direct deposit | In about four weeks | |

| Check | In about four weeks and an additional one week for check delivery |

What Are The Reasons For Delay In Tax Refund?

There can be multiple reasons as to why your tax refunds have been delayed. One of the most common ones out of these reasons is an error in the return file. This includes errors like wrong Social Security Number or wrong direct deposit information. The Internal Revenue Service (IRS) may also intentionally delay your tax refund in case it requires an additional review or is incomplete.

It is also important to note that if you have claimed the earned income tax credit or an additional child tax credit, the IRS cannot legally issue your refund before mid-February. This year, early EITC filers as well as the ACTC filers without any errors chose direct deposit as their method of refund may expect on their return on the 3rd of March 2025.

In case you are still facing delays in your tax refunds three weeks after filing your return online and six months after filing your return offline, you may track your refunds using the tracker. You may also contact the agency through their official hotline number.

Also read: IRS Refund Schedule 2025: When Will You Get Your Tax Refund?

What To Do To Receive The Tax Refunds Sooner?

If you are someone who faces delays in receiving tax refunds often and wish to know what you can do to receive the refunds sooner, we have your back. The following are a few things you can do to ensure you receive the tax refunds on time.

Avoid Filing Tax Returns Offline

If you wish to receive your tax refunds at the earliest, the first thing you must do is avoid filing tax refunds offline. It usually takes weeks for the IRS to process the paper returns. On the other hand, e-filing of tax returns is processed in much less time if compared to offline tax filing. State Tax authorities also accept electronic tax returns filing as well. This means, using the e-filing method you can also expect to receive your state tax refunds sooner as well.

Opt For the Direct Deposit Refund Method

Another thing that you must do if you wish to receive your tax refunds on time is to opt for the direct deposit method of receiving refunds. This basically means you will have to tell the Internal Revenue Service to deposit the refunds directly into your bank account at the time of return. This will save you so much time you might have had to spend checking mail and refund status. You can also have the IRS split your tax refunds across various accounts. These accounts may include your retirement account, health savings account, or your college savings account.

Track Your Tax Refunds

If you are someone who has filed a tax return through the tax software, you can start tracking your tax refund status within the next 24 hours. In case you haven’t received your refunds within three weeks of e-filing tax returns or six weeks of offline tax return filing, you may contact the agency regarding the delay. These steps may not fasten your tax refund process, but at least you will have more information about what’s delaying your refunds. Remember, your tax refunds may face some delays if your return filing is not error-free.

One Thing To Avoid While Filing Tax Return

One thing you may want to avoid when filing your tax return is overpayment of the taxes. Now, receiving a big check from the government as tax refunds may seem like an attractive idea. But, a huge tax refund check basically means you are unnecessarily overpaying your taxes. This leaves a rather less section of your paycheck in your hands throughout the year.

Let’s understand this with an example. If you are receiving a $3,000 check as a tax refund, this means you are giving up $250 every month. If you think about it, having an extra $250 in your hand will help with the bills more. Hence, you can give your employer a new IRS Form W-4 and adjust your withholding. This will help you get the money now rather than later. Avoiding overpayment of taxes will ultimately leave you with more money in your hands at the end of the month. For many taxpayers, this can actually be a life-changing hack.