The tax base relates to the total population of individuals who are liable to pay taxes in other countries. In layman’s language, it can also be defined as an income, a capital, or a policy that is fully recognized for taxation purposes. This understanding of how to determine the tax is important for individuals, businesses, and governments, as it is used as the basis for computing tax obligations. This guide tells exactly what a tax bases is, its elements, how to calculate a tax on a simple formula, and provides other examples that help the reader understand why a tax base is important.

What Is a Tax Base?

Essentially, the tax base means that the income of a sales tax is computed by multiplying the relevant sales with the specific sales tax rate. So the tax is effective for an entire economy based on the increasing assets that are taxed within every society. The actions that need to be taken concerning various assets are in the form of collateral assets such as money, income, capital, property, and commodities, which are in terms of consideration rewarding to achieve gains or returns in the long term.

Also read: Top States with No Income Tax in the USA: Living Tax-Free

Key Characteristics of a Tax Base:

- It represents all taxable economic activities within a jurisdiction.

- It is influenced by deductions, exemptions, and credits that may narrow the taxable amount.

- A broader tax base allows governments to generate revenue at lower tax rates, improving efficiency and neutrality.

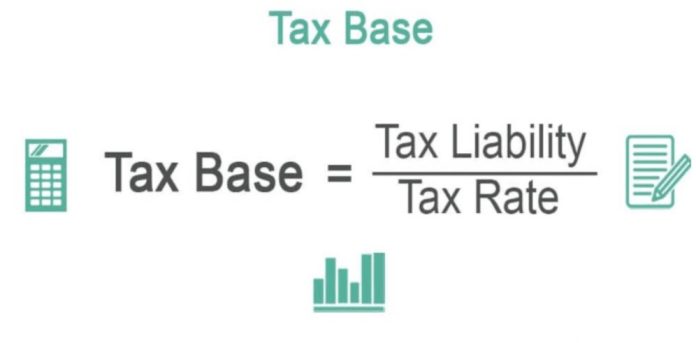

Formula to Calculate Income Tax Liability

The tax liability is calculated using this formula.

Tax Liabilities= Tax Base X Tax Rate

Suppose a person earns $50,000 in a year with an income tax rate of 10%. His tax liability would be:

50,000×0.10=5,000

What are Tax Components?

There exist several variable tax bases that can broadly be classified as founded and include:

- Income as a Tax Base:

Generally, There is income taxation among individuals and companies. We subtract any tax credits or deductions from gross income to determine taxable income. The Internal Revenue Service (IRS) provides tools like Form 1040 to compute individual income tax bases.

- Property as a Tax Base:

The assessed value of the real estate, or building assets becomes a tax base for properties. Property tax revenue often goes to the provision of services that are sanitized such as education and infrastructure in a locality.

- Sales as a Tax Base:

There exists a tax base in retail price that surrounds goods and services purchased at the end of the sale. To assist people of lower income, food, basics, and medications may be nontaxable items to ease their tax burden.

- Capital Gains as a Tax Base:

There are assets such as stocks or real estate which when sold off at a profit enable one to create a taxable gain. There are also capital losses that can reduce the taxable gain availability and thus tax bases are weakened.

Also read: The Future of Remote Work: Opportunities and Challenges Ahead

How to Calculate Tax Base in Simple Terms

- Personal Income Tax

Let’s take an example of a person named Margaret, with a gross income of $50,000. After all deductions, her income after tax is $30,000. The tax rate is 10% and that means she has to pay the following amount in taxes:

30,000×0.10=3,000

- Property Tax

A homeowner has a property worth $200,000 and the tax rate applied in the area is 2%, therefore, the property tax that the owner is liable to pay is:

200,000×0.02=4,000

- Capital Gains Tax

An investor trades in stocks for a profit of $20,000 and after adding losses, the total gross amount is $15,000. As this is a profit margin, the long-term tax applicable is $15,000*15% which is:

15,000×0.15=2,250

What Happens in a Wide Tax Base vs a Tight Tax Base

In general terms, how much a base is broadened or confined affects taxation policy as well as revenues.

Broadening the Tax Base means there’s a step taken to span a larger area economically. Doing this would make it easy to generate earnings even with lowered tax rates. For example, extending taxation to the sale of goods to encompass exports.

However, Constricting the Tax base means one is limiting the taxation to certain areas or groups. Moreover, High taxation becomes mandatory for the same returns that would have been received otherwise on a wider area.

Example:

In the twentieth century, state sales taxes only applied to goods due to the fact that they covered over 60% of the consumption. In modern times, that trend has shifted due to the fact that consumption is over 60% composed of services and numerous individuals remain sales tax exempt. One suggestion to increase this trend is to increase the tax base to include services thereby making overall taxes lower.

Also read: How to Evaluate An Employee Performance: Tips for Managers

Reasons which influence the Tax Base

- Deductions, Exemptions, and Credits:

- This leads to a lower taxable percentage of income or assets.

- Examples: Mortgage interest deductions, child tax credits, and sales tax exemptions for essentials.

- Alternative Minimum Tax (AMT):

- In essence, AMT ensures that those with high-income earners must pay a certain percentage of tax after adjusting for all exemptions, or deductions.

- In certain cases aids in increasing the tax base of those people.

- Tax Policies:

- Additionally, there is a possibility that governmental bodies can expand the tax base by removing exemptions or imposing taxes on those activities that were previously untaxed.

Examples of Tax Jurisdictions and Tax Bases

- Federal Taxes:

- Taxable Income is the major tax jurisdiction within the federal taxes whereby income tax is levied.

- Realized capital gains from investments incur capital gains taxes.

- State Taxes:

- Any good or service sold attracts an appropriate sales tax at the retail level.

- Real estate indicates the property tax bases.

Also read: Maximizing Tax Deductions For Your Business Vehicles

Final thought

The phase of determining the tax base is one of the first steps in the taxing process, and it is one of the most essential indicators that affect both the amount of taxes due and the revenue potential of a government. The tax concept helps citizens and companies meet their liabilities as well as governments provision equitable fairness in the tax systems.

Whether it is income, property, or sales tax bases elements are very important to ensure the desired intention of taxation is achieved which is equity and economic stability and growth. If tax systems are made to work with broad bases and adjusted rates many good things will come.