The break-even point is the point at which a business’s entire income equals its entire costs. At this juncture, the business is not generating any profit. However, it is not losing money. Understanding the break-even point is integral for any business person to navigate how much product is being sold to cover the costs. Continue reading to learn all about how to calculate break-even point in business.

Characteristics of Break-Even Point

Firstly, the individual needs to understand that these costs do not change regardless of how much they produce. Examples of these include rent, salaries, and insurance. The costs vary depending on the production level. For instance, the cost of materials or labor which increases with each unit produced.

Moreover, one ought to be conscious of the selling price. This is the amount at which the merchandise is sold. Along with this, they should also know about gross profit margin. This is identified as the difference between the selling price and the variable costs. This is expressed in a percentage of the selling price.

Also read : Top 5 Business Trends in 2025: AI, Sustainability & More

Calculating the Break-Even Point

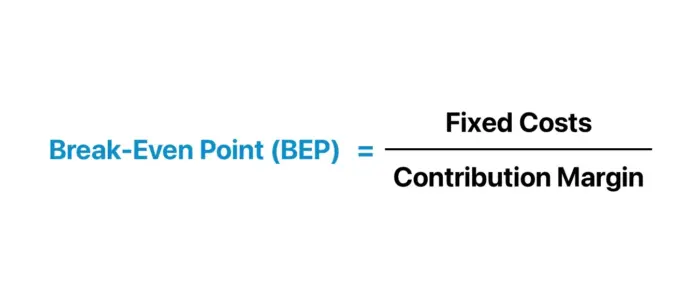

To derive the break-even point, one can employ this formula. This is,

Break-Even Point (in dollars) = Fixed Costs/Gross Profit Margin

To calculate this, one has to determine all their fixed costs. For instance, if their fixed costs total $1 million, this is the amount they need to cover.

Next, one has to identify the selling price per unit and the variable cost per unit. This is done with the formula,

Gross Profit Margin = Selling Price – Variable Cost/Selling Price

For instance, if the product is sold for $10 and the variable cost is $3, then,

Gross Profit Margin = 10-3/10 = 0.7 or 70%

Using the fixed costs and gross profit margin, one can plug the numbers into the break-even formula.

Break-Even Points = 1,000,000/0.7 = 1,428, 571

This means that the individual ought to generate about $1.43 million in revenue to break even.

Finding the Break-Even Points in Units

To know how many units one needs to sell to break even, one can use the contribution margin. It is calculated as,

Contribution Margin per Unit = Selling Price – Variable Cost

Using the earlier example, it is calculated as,

Selling Price = $10

Variable Cost = $3

Contribution Margin = $10 – $3 = $7

Finally, to derive the break-even points in units,

Break-even point (in units) = Fixed Costs/ Contribution Margin

Break-even point (in units) = 1,000,000/7 = 142,857

Significance of Break-Even Point Analysis

Understanding Break-Even Analysis can help identify one’s fixed and variable costs. This can ensure better budgeting and financial planning. Also, knowing one’s break-even point helps set the prices that cover costs and generate profit. Along with this, it helps set clear sales targets. This allows for easy marketing plans and sales strategies.

Investors often want to know the break-even points. This is to understand the risks and potential of running the business. Finally, regularly calculating the break-even point can help monitor one’s business health. It can help the business person in making informed decisions.

Also read : Top Companies in the US to Watch in 2025: Innovation & Growth

Limitations of Break-Even Point

Although it is highly useful, the break-even point can also have its cons. Firstly, it assumes that all costs are neatly categorized as fixed or variable. In reality, however, some costs may not fall under these categories. This can lead to imprecision in the calculation. Along with this, the calculation assumes that selling prices and variable costs remain constant. This is often not the case. Prices are known to fluctuate. Also, costs can change from time to time. Sometimes, the break-even points does not consider market competition, customer preferences, or economic conditions. All of these can highly affect the sales of the business. It is integral to consider all these aspects before utilizing the break-even points.