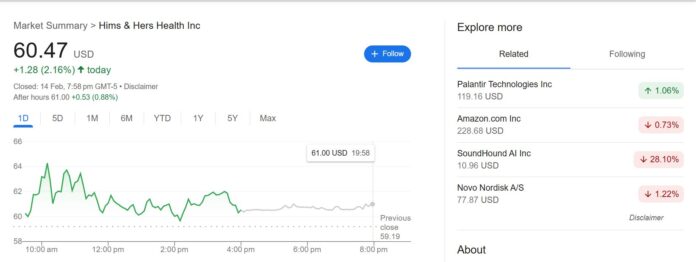

Hims and Hers Health Inc. (NYSE: HIMS) has been among the most popular names in the stock market as it has seen amazing growth recognized not just from stock price growth but even from overall market growth. In this regard, it has reached its all-time high share price at $46.11, and with its present value at $59.18 (with pre-market estimates at $61.20), the price movements are monitored closely by investors of the stock on its growth.

Some of the factors that have propelled such a rapid escalation in market value include the innovative telehealth service model that the company has adopted, strategic marketing, and diversification into weight loss solutions. However, it is still under the shadow of regulatory attention and competitive threats, which this article looks into in-depth analysis on the stock HIMS in terms of present performance as well as growth drivers, future prospects, risks, and views hereinabove.

Recent Performance and Market Sentiment

Hims and Hers Health have shown tremendous stock growth so far-swinging 27.71% in a single day-it has done a remarkable 385.02% over the year, making it one of the fastest gainers in health and wellness stocks. In fact, the momentum pointing towards this development depicts the faith of investors in the ability of the company to expand and tap into the accessible trends of the market.

This most recent high on the stock at $59.55 is an indication of catabasis momentum, while its opening price as at February 14th at $47.53 was one bullish mood for the stock. With pre-market estimates at $61.20, analysts keep a watch or eye on the stock to see if HIMS would hold on this trend or see correction based on fears of overvaluation.

Also read : JoAnn Fabrics Closing 500 Stores: What’s Happening?

Growth Drivers

Expansion of the Weight Loss and Wellness Market

The latest Super Bowl advert about the weight loss product raised investor confidence significantly. Increased website activity after the ads shows consumers want more from HIMS. This, combined with what has been a broader growing expectation in healthcare, is between the obvious upward gains attributed to weight loss products and customized wellness products.

Robust Revenue Growth and Positioning in the Market

Analysts pointed out this innovative business model of the company and its ability to capture large portions of the digital health market. Companies like BTIG rated HIMS a Buy on the basis of future robust revenue growth expectations especially on its GLP-1 and obesity health product lines.

Strategic Marketing and Branding

It has turned a sector into a brand, leveraging social media and digital marketing at Hims & Hers Health. Personalizing its healthcare solutions, with direct-to-consumer engagement, has added value to the market entry achieved.

Challenges and Risks

Regulatory and Challenges for Pharmaceutical Industry

HIMS has been more successful in winning operations over regulatory discomfort. HIMS faces the challenge of being able to market and gain revenue from its compounded GLP-1 products. According to an underperform note from BofA Securities, drugmakers could mount contested approaches to delivery from HIMS for such treatments, further affecting the company’s ability to grow its weight management offerings.

Competitive Landscape

The arena of telemedicine and digital health is, to say the least, very competitive, with Teladoc Health and Ro among the other players offering similar services. Continuous innovation, strategic partnerships, and measures to retain the customers would hence become a necessity for the competitive edge.

Stock Volatility and Corrections in Market

The new 27.71 percent increase has come in a day. Expected are moves by some traders to take profits in the near term, which will produce fluctuations on the price in the short run.

Analyst Ratings and Market Predictions

- Needham & Company: Last week upgraded the price target HIMS. “We’re making it our number-one digital health pick for 2025,” they said. They noted the very favorable personalization healthcare entering the door for the firm.

- BofA Securities: Underperform rating due to resistance seen coming from pharma against compounded GLP-1 products.

- BTIG: Initiated with a Buy rating expecting powerful revenue growth.

All this body of opinions shows the mixed sentiment concerning HIMS stock, and thus the research by investors becomes paramount before they invest.

Future Outlook: Will HIMS be able to grow?

The future of Hims and Hers Health predominantly relies on its ability to circumvent regulatory hurdles, maintain competitive differentiation, and continue on the growth trend of revenues. Some of the components to observe are:

- New Product Development: New healthcare solutions are launched outside the sphere of weight loss and sex wellness.

- Partnerships and Acquisitions: Alignment with health care providers and technology companies to increase service capabilities.

- International Expansion: New markets would possibly mean added growth opportunities.

Traps for The Investors

As currently HIMS stocks are rising. As an investor, you might be tempted to put in some money and earn some profit through this opportunity. However, we urge our readers to be attentive to earn profit and minimise the chances of the lost. For this, one can read the charts carefully and follow the experts to get their opinion on the HIMS and carefully examine the future of the stocks. And, don’t forget to judge the right exit point to earn more profit and decrease the chances of profit. Hence, being cautious and putting your money at the right time on the right stock might earn you easy money with lesser loss.

Also read : Starbucks New Lawsuit in Missouri: Race-Based Hiring Claims

Conclusion

HIMS stock performed well and in a manner investors consider a very bullish indicator of confidence in the business model. Yet regulatory issues and competitive rivalry pose real threats to strong growth. There are diverging views from analysts right now, but recent movement in the stock suggests growth may still be ahead. Investors should watch closely the next earnings reports along with regulatory developments and competitive positioning to make an informed choice. If HIMS can continue to have a vision to evolve and innovate rapidly, it will be a long-term leader in the digital health market. Be cautious and invest carefully to take the benefits of this HIMS rise.