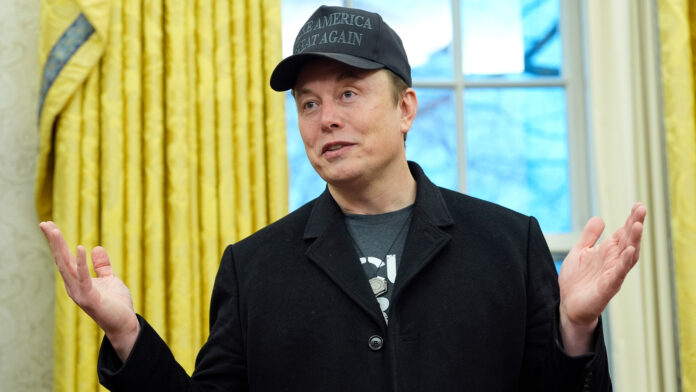

The Department of Government Efficiency (DOGE), created by Elon Musk, has been making headlines with its call to access the Internal Revenue Service (IRS) system. It has ignited a cacophony of debate around privacy, governmental transparency, and risks. Allegedly backed by the White House, this move aims to tackle fraud and waste in federal expenditure. But then, privacy advocates and government officials have been truly uncomfortable with the consequences of having DOGE access such private data about taxpayers.

DOGE’s Ambitious Mission

DOGE was formed under the direction of Musk to make the government more efficient and cut what it sees as waste. From the early days of Trump’s presidency, a good focus on cutting spending and holding agencies accountable for how they spent taxpayer money was brought about. The most ambitious attempt yet of DOGE in its fight against inefficiency in government spending has been to gain IRS data access.

According to The Washington Post, DOGE is also asking for access to all IRS systems, particularly the Integrated Data Retrieval System (IDRS). It is a highly restricted database, allowing real-time information access about individual taxpayer accounts, and hence would be classified as among the most confidential government systems. Currently, access to pretty much any information within this system is severely restricted, with intentionally limited data withdrawable by a handful of IRS officers.

Also read : Laraine Newman Honors Gilda Radner at SNL 50th Anniversary

Privacy and Security Dangers

The bid to gain access to IRS data has faced stiff resistance from governmental leadership and civil rights caretakers. Detractors warn about the bad precedent of letting DOGE access taxpayer information. ABC News stated that Elizabeth Laird, formerly with the state privacy protection and now with the Center for Democracy and Technology, is worried.

When individuals give their most personal information to the federal government, they expect it to only be used lawfully and reasonably,” stated Laird. “This act causes justifiable concern about identity theft and personal intrusion.”

Millions of Americans have their extensive financial data repositories in the IRS, which include income, deductions, and possible audit trails. In the unfortunate event that access is granted, there could be fears that access will be abused by DOGE, notwithstanding the potential for unintentional breaches. Cybersecurity experts warn that too much emphasis on access to such a large data pool could actually increase the risk of data leaks or hacking attempts.

Defense by the White House

Nonetheless, the White House has defended DOGE’s request. Harrison Fields, a member of the administration, argued that direct access to the IRS system for the identification and elimination of waste is the least that can be done.

“Waste, fraud, and abuse have long been entrenched in our dysfunctional system for far too long. It requires access to the system directly in order to spot and correct it. DOGE will keep putting a spotlight on the fraud that they expose, as the American people need to know what their government has been spending their hard-earned tax dollars on,” Fields stated.

According to the administration, more transparency for the federal government may lead to substantial savings and make sure that taxpayer resources are wisely deployed. There is no mention as to how DOGE will safeguard against unwarranted access or how security will be maintained in an equivalent way to that used by the IRS.

Political and Legal Implications

The proposal raises legal questions of presidential power and control. Some lawyers believe that the extra-legal granting of such vast access to IRS data by a third party would violate privacy regulations. Others suspect that should the measure be cleared, it will receive legal opposition from civil rights groups or members of Congress concerned about executive overreach.

Also read : Is Presidents Day a Federal Holiday? Significance & What’s Open

Conclusion

As of now, DOGE’s requests for IRS access are still pending. The debate has since gained traction, with proponents on one side supporting full transparency and opponents on the other warning against violations of privacy. But if it works, this could serve as a landmark opportunity to supervise the very government that supervises taxable funds—yet a very big question pops out: At wha