In a big boost of mergers set to roll out sport-retailing in American on a new pitch, Dick’s Sporting Goods is reported to be working on its final stages to acquire Foot Locker for approximately $2.3 billion. People familiar with the matter who were cited by The Wall Street Journal said that Dick’s had made a $24 per share offer for Foot Locker — an 86.5% markup over Foot Locker’s current closing price. The premium offer shows Dick’s high demand for the completion of the deal that can be publicly declared this week. Upon its completion, the acquisition would be one of the biggest retail acquisitions in the recent years as reflection of a strategic bid to further bolster Dick’s dominance in the athletic and footwear industry.

Details of the Acquisition

Acquisition of proposal will be at an all cash offer and Foot Locker’s worth will be at $2.3 billion. The deal, which is said to be at $ 24 a share, is much higher than the recent trading levels that Foot Locker has experienced, meaning that Dick’s is willing to pay top dollar in order to get the deal done and keep other bids away. Although neither of the companies has made an official statement, the market is already responding to the news as there are speculations being made on the possible strategic synergies behind such a merger. Industry insiders say the deal is in the final stage of negotiation and might be settled down within days if not hours.

Also read: Tigres – Toluca Clash In Liga MX Semifinals: First Leg Ends In A Tie

Strategic Rationale Behind the Deal

The possible acquisition is taking place as competition and rivalry continue to grow in the athletic retail space, especially from direct-to-consumer strategies used by brands such as Nike and Adidas. These brands have increasingly withdrawn from third-party retailers and focused on their physical stores as well as online stores, complicating things for traditional chains. To Dick’s Sporting Goods, Foot Locker acquisition offers the chance to consolidate market share as well as diversify its customer base and strengthen its omnichannel position.

Foot Locker’s Transformation: The ‘Lace Up Plan’

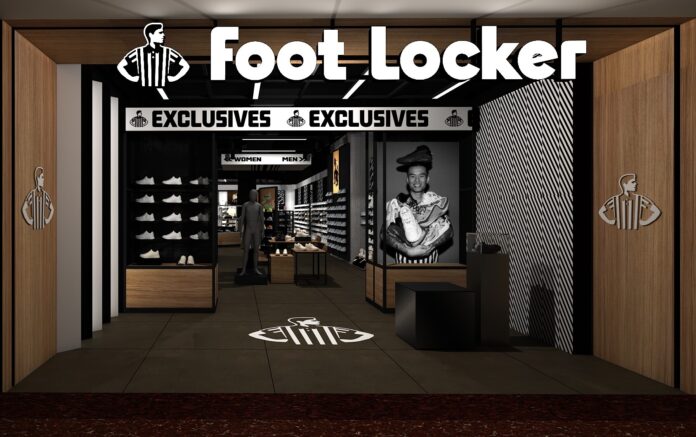

Foot Locker has spent the last year in the process of a major transformation as part of “Lace up plan”, which is a strategic plan to revitalize its brand and operations. The plan involves diversion of under performing mall locations, and new retail format that cater to modern shopping habits, and large-scale investments in digital infrastructure. Foot Locker has also redesigned its loyalty programme with a view to increase customer retention and engagement. Most prominently, it started a Global Technology Services Hub in Dallas in Texas to support its technological modernization and backend operation. Though these are positive efforts, which reflect a forward-looking strategy, the share price and earnings of the Foot Locker have since remained behind with the company being a prime candidate for acquisition.

Market Reaction and Investor Implications

The early reactions on the market have been very speedy following the news, with Foot Locker’s stock increasing on speculation of the buyout even as Dick’s shares exhibited minor falls. In relation to investors, the acquisition is seen to be a potentially transformative situation that may lead towards the creation of great long-term value through operations synergies, cost efficiencies and expanded market reach. Financial analysts believe that the merger can give Dick’s a stronger stake in the cutthroat world of retail where the merged entity can push for more profitable relationships with the suppliers and win a bigger consumer base. Nevertheless, there are questions on integration hurdles and future branding of Foot Locker under Dick’s belt.

Broader Industry Implications

This potential acquisition is representative of a general consolidation in retail. With increasing numbers of consumers moving to do digital shopping and with brands choosing to sell their products directly to clients, conventional retailers are forced to transform or merge in order to survive. The Dick’s – Foot Locker deal, if it is closed, might serve as a precedent for other consolidations of the athletic and apparel retailers to increase its business quickly and remain competitive on the market.